Content

The cash accounting method records the revenue and expense transactions when the payments are paid out or physically received. Although it’s the more complex of the two major accounting methods, accrual accounting is considered the standard accounting practice for most organizations. Using accrual accounting, companies look at both current and expected cash flows, which provides a more accurate snapshot of their financial health.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- It results in a decrease in cash and an equal decrease in a liability.

- In previous sections, doctrinal research has been shown to frame the existing law in this specific topic.

- The financial information recorded under accrual accounting enables the business to calculate key financial metrics such as gross profit margin, operating margin, and net income.

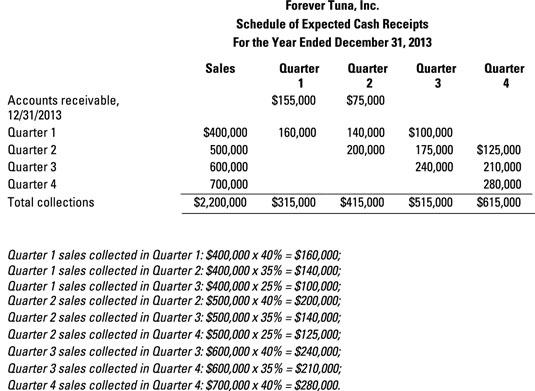

In every quarterly result, they record the revenue, the profit generated, the gross profit margin, their assets and liabilities, etc. Cash accounting is quite inefficient in measuring these factors and show how a business performed in a particular period. Cash Accounting has no provision to account for payments that will be received in future. Hence, such companies must adopt the Accrual Principle of Accounting. The Accrual Principle is a concept in Accounting where the financial transactions are recorded during the same time period in which they occur.

Is there any Effect Of Not Applying The Accrual Principle?

The statement of retained earnings is the report that tells how much of the money that a company made was retained and reinvested in the business. The balance sheet is the report that lists all the accounts that a company has and their balances. Cash Accounting is mostly limited to businesses that operate at a small scale and generate less revenue.

What is the accrual principle?

The accrual principle requires that transactions be recorded in the period that they occur in regardless of when the actual cash is exchanged. The accrual principle is the basic requirement for all accounting frameworks such as IFRS or GAAP.

For example, suppose a company supplies goods worth $50,000 in the first quarter of financial year, but the company receives the payment in the second quarter. In such a case, if we apply https://online-accounting.net/, then the company will record this financial transaction in its books in the first quarter itself.

What is the difference between accrual accounting and cash accounting?

In this case, an inconsistency arose from the TA wrongly interpreting the accrual principle and arguing for the deduction of the depreciation in one company while refusing it in the other. The court decided in favour of the taxpayer, resulting in the reversion of the correction, without appealing to the principle of justice. Revenue is not difficult to define or measure; it is the inflow of assets from the sale of goods and services to customers, measured by the cash expected to be received from customers. However, the crucial question for the accountant is when to record a revenue. Under the revenue recognition principle, revenues should be earned and realized before they are recognized . Under taxation , however, companies may elect to present financial statements as either under accrual or cash. The income statement is the report that tells how much money a company made or lost in a specific time period.

Graham, Raedy, and Shackelford observed that that the primary user of this information may be an adversarial party, such as the TA. Therefore, this type of accounting faces the challenge of balancing information provision to The accrual principle the TA and other stakeholders. The main purpose of accounting information is to provide a true and fair view of the economic organisation of reporting entities in order to support economic decisions by their stakeholders.

Accrual concept. Explanation, benefit and presentation

The differences between accrual and cash accounting also have significant tax implications. For example, a potential tax consequence of accrual accounting is that tax payments may be due on revenue that has been recognized, even though the company has not yet received the cash for some of those transactions.

- The result is that a company’s reported revenue for a particular period typically differs from the cash it collects from customers during that period.

- Similarly rental are reported as expense when they fall due and not when actually cash is paid in this regard.

- Accrual accounting can provide a more accurate overview of a business’s performance over a specific period because future revenues and expenses can be accounted for.

- The accrual method of accounting is based on matching revenues against expenses in the period in which the transaction takes place, instead of when the payment is processed, which is the procedure with cash accounting.

- In such an instance, the payment is initially recorded as a liability for the seller .

For each category of adjusting entry, we will go into detail and investigate why these are necessary to make at the end of the accounting cycle. DebitedDebit represents either an increase in a company’s expenses or a decline in its revenue. Credit SalesCredit Sales is a transaction type in which the customers/buyers are allowed to pay up for the bought item later on instead of paying at the exact time of purchase. It gives them the required time to collect money & make the payment. An expense is the cost of operations that a company incurs to generate revenue.

Matching Principle

Differentiate between cash-basis accounting and accrual-basis accounting. Explain the importance of accrual accounting and proper application of the matching principle for the computation of contribution margins and break-even points.

This method of accounting doesn’t give a financial statement user the most complete and accurate picture of a company’s financial health. The accrual accounting method is based on matching revenues against expenses in the accounting period the transaction takes place instead of when the payment is received/processed. One of the biggest reasons businesses hesitate to use accrual accounting is the time and effort required to maintain the books and records. It is more complex to manage accounts receivable, accounts payable and prepaid or deferred assets than to simply track cash in and cash out under the cash basis method. Additionally, the accrual method requires companies to close the books more frequently (i.e. monthly, rather than annually). Further, companies generally manage subsidiary ledgers like accounts receivable and accounts payable more frequently, on a weekly or biweekly basis. When a business wants to examine its actual performance during a specific period of time – such as a quarter or one fiscal year, the accrual method of accounting is a useful tool.

In GAAP, you are free to choose between the two methods if your annual sales are below $5 million. Both IFRS and GAAP mandate the use of accrual method for recording all revenue and expenses. When XYZ delivers the construction materials to LMN, it enters the transaction as revenue in its books. When the payment is received or is to be received does not affect the revenue entry in the books of accounts. They come in the form of accrued revenues/expenses, where they are recognized at the point of transaction without the receiving/payment of cash and cash equivalents. Moreover, hundreds and thousands of financial transactions need to be recorded in a single day under this accounting if a business is enormous. Maintaining all of these daily, day after day, is not an easy job for an accountant.